insurance basics

types of insurance coverage

How do I avoid unexpected balances?

The best way to prevent surprise balances is to fully understand your insurance benefits and keep us updated on any changes to your coverage.

You are responsible for:

Verifying your benefits before starting care.

Informing us promptly of any changes or lapses in private insurance or Medicaid.

Updating us if major life changes occur that may impact your coverage (e.g., marriage, pregnancy, changes in disability status, turning 65, moving, or changing jobs).

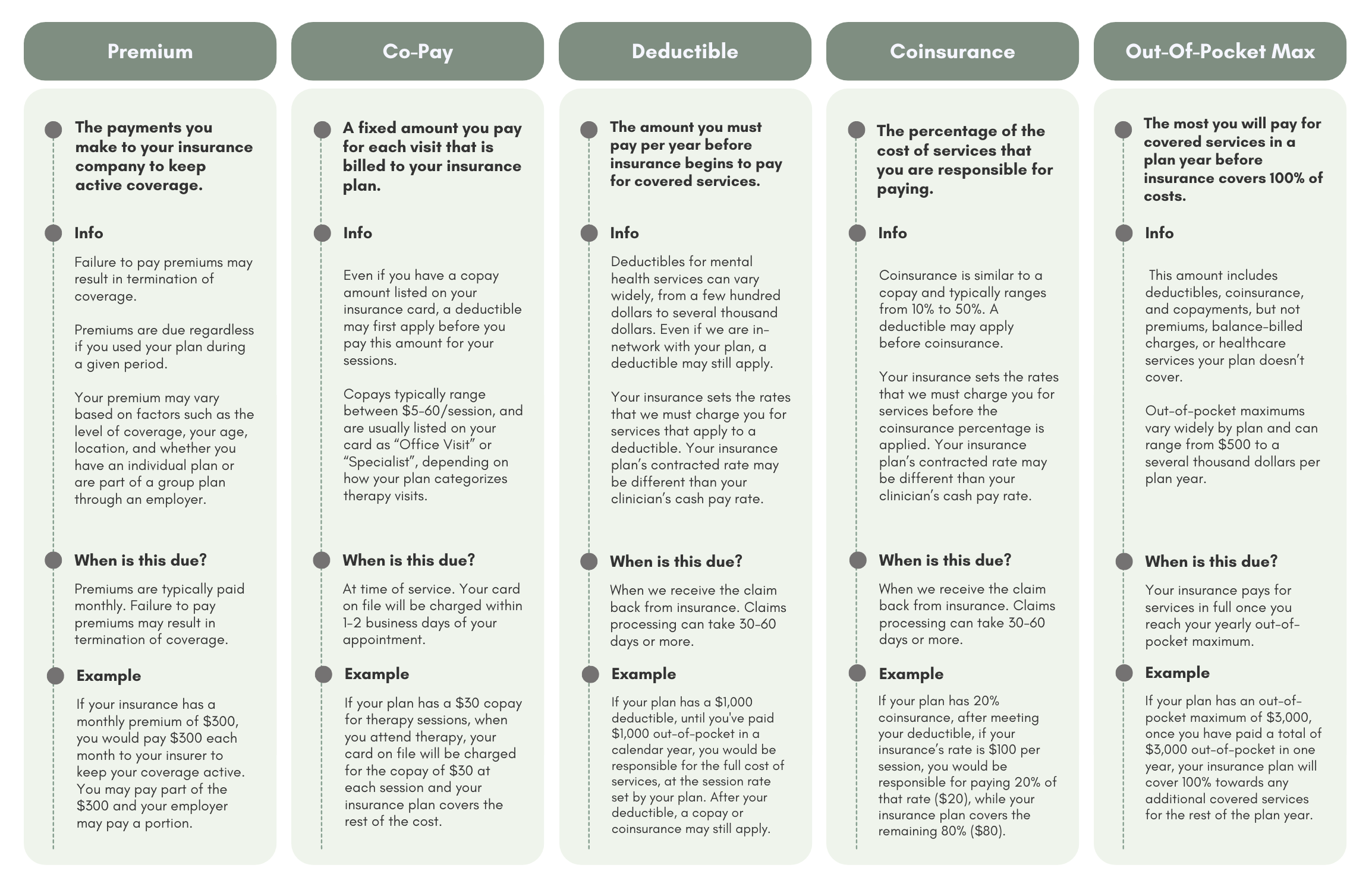

While we can usually estimate your copay, if your plan has a deductible or coinsurance, your final cost can vary. We bill for coinsurance or deductible amounts after your claim processes, since other medical visits you have may affect what you owe.

Claims can take 30–60+ days to process, so errors may not be discovered until you’ve already had multiple sessions.

insurance terms

What mental health services does my insurance plan cover?

Coverage varies widely. Review your policy or contact your insurance provider directly to confirm:

Which services are covered.

Applicable copays, deductibles, or coinsurance.

Whether services are billed under an office visit or specialist rate.

Your Summary Plan Description will give more detail than your insurance card alone.

How do I verify my coverage?

Visit your insurance provider’s website.

Call the customer service number on your insurance card.

Review your policy documents.

Ask specifically about:

Copays, deductibles, and coinsurance for mental health.

Whether telehealth is covered.

Any preauthorization requirements.

What if my plan doesn’t cover mental health services?

Most private insurance plans offer some mental health coverage, but you may still owe part—or all—of the session fee through deductibles, coinsurance, or copays.

If your plan is employer-funded (your employer pays your health expenses directly), check carefully to confirm mental health coverage.

Do I need preauthorization for mental health services?

Some plans require preauthorization (prior approval) for mental health care. Call your insurance provider before starting sessions to confirm if this applies to you.